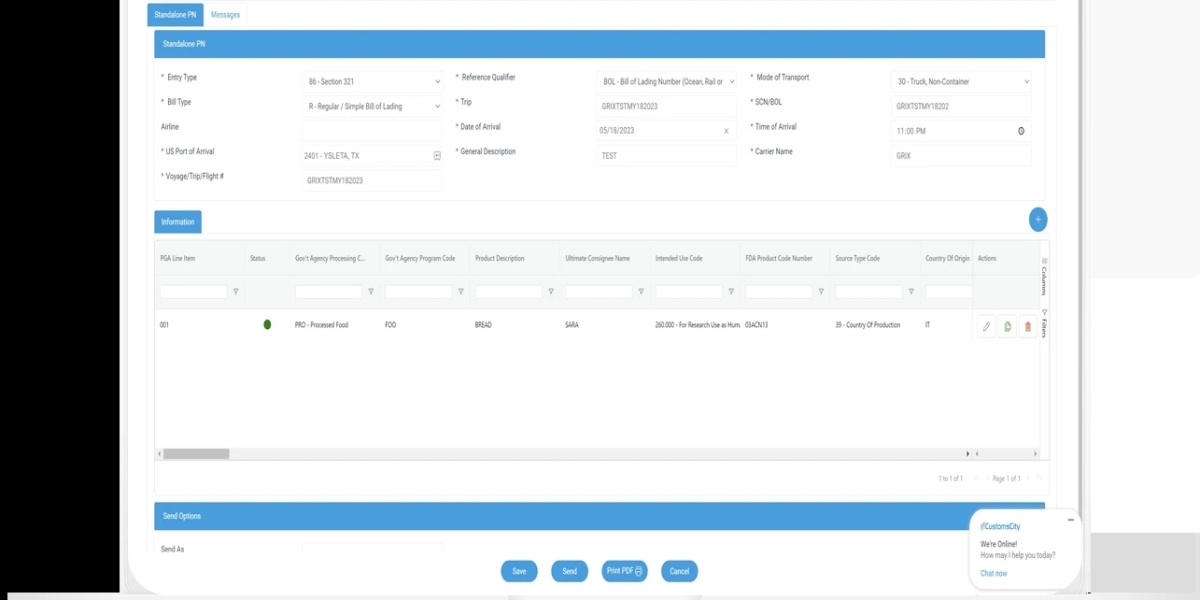

FDA imports involving Section 321 under U.S. Customs and Border Protection (CBP) have seen significant regulatory changes as of 2025. Section 321 traditionally allowed low-value shipments valued under $800 to enter the U.S. duty-free, simplifying import processes for many businesses. However, the de minimis exemption no longer applies to FDA-regulated products, meaning all such imports require full FDA review before clearance.This policy shift reflects advancements in technology that enable the FDA and CBP to thoroughly assess every shipment electronically, regardless of its value. Importers of FDA-regulated goods must now comply with stricter entry requirements to avoid delays and ensure compliance with U.S. regulations.Understanding how these changes affect import procedures is crucial for businesses and individuals shipping FDA-regulated products. This article explores the implications of Section 321’s evolving role and what importers need to know to navigate the updated landscape efficiently.

Search

Popular Posts

-

Philippines Bulk SMS Gateway: Why s8seo.com Is Your Best Choice in 2025

By Loy Windler

Philippines Bulk SMS Gateway: Why s8seo.com Is Your Best Choice in 2025

By Loy Windler -

The Future of 5G RedCap: Unlocking New Possibilities in IoT

By phtee

The Future of 5G RedCap: Unlocking New Possibilities in IoT

By phtee -

Philippines Bulk SMS Gateway: Why s8seo.com Is Your Best Choice in 2025

By Loy Windler

Philippines Bulk SMS Gateway: Why s8seo.com Is Your Best Choice in 2025

By Loy Windler -

Smart Wi-Fi for Public Spaces: Enhancing Connectivity and Urban Engagement

By phtee

Smart Wi-Fi for Public Spaces: Enhancing Connectivity and Urban Engagement

By phtee -

Exploring Every Funky Time Bonus Game in Detail

Exploring Every Funky Time Bonus Game in Detail